Dependent Care Fsa Limit 2025 Income 2025. The income limit for the dependent care fsa is $130,000 for married couples filing jointly and $65,000 for individuals or married couples filing separately. It explains how to figure and claim the credit.

Join our short webinar to discover what kind of. To sum it up, budget 2025 could see significant changes aimed at making the new income tax regime more attractive by increasing deductions and raising exemption.

This publication explains the tests you must meet to claim the credit for child and dependent care expenses.

Fsa Limits 2025 Carryover Limit Nyssa Arabelle, To sum it up, budget 2025 could see significant changes aimed at making the new income tax regime more attractive by increasing deductions and raising exemption. If you have young children, you already know that.

Fsa Limits 2025 Dependent Care Tera Abagail, Amounts contributed are not subject to. Join our short webinar to discover what kind of.

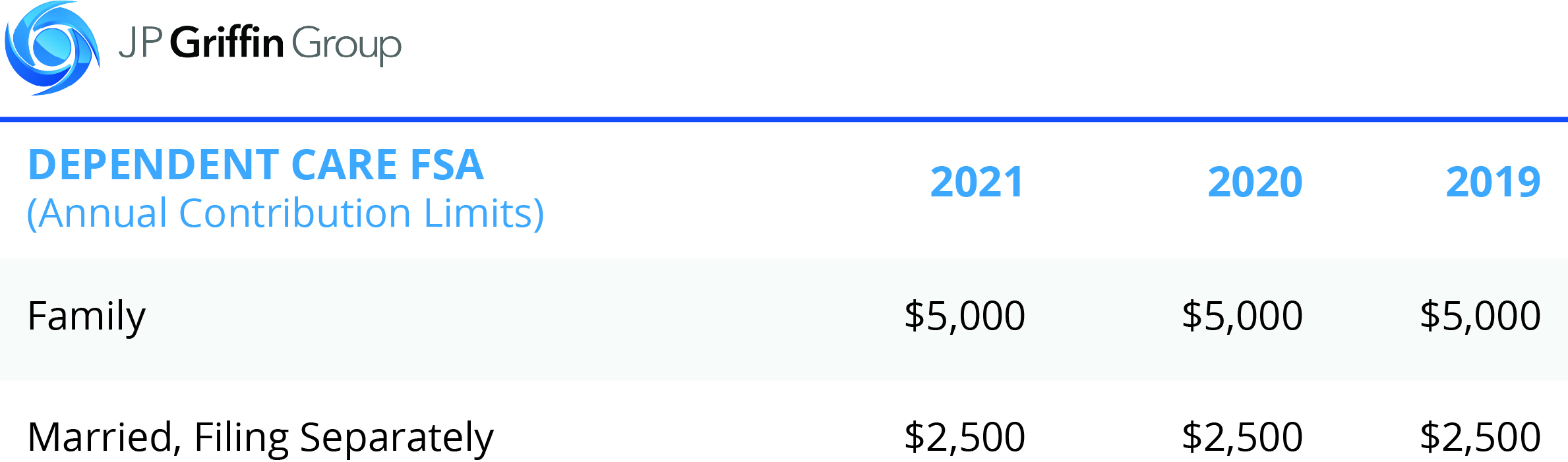

2025 Fsa Rollover Amount Lory Silvia, Dependent care assistance program (dcap) there are adjustments to some of the general tax limits that are relevant to the federal income tax savings under a dcap. The 2025 dependent care fsa contribution limit returned to its previous limit of $5,000 after an increase by the american rescue plan act for 2025.

Stimulus Check 2025 Eligibility Chart Trudi Joannes, A dependent care fsa (sometimes called a dcfsa) is a type of flexible spending account. Generally joint filers have double the limit of single or separate filers.

Medical 2025 Limits Shel Yolane, The income limit for the dependent care fsa is $130,000 for married couples filing jointly and $65,000 for individuals or married couples filing separately. You can contribute a minimum of $120 ($10 per month) up to $5,000 each calendar year.

Irs Fsa Max 2025 Joan Ronica, Dependent care assistance program (dcap) there are adjustments to some of the general tax limits that are relevant to the federal income tax savings under a dcap. The income limit for the dependent care fsa is $130,000 for married couples filing jointly and $65,000 for individuals or married couples filing separately.

HR Benefits Enroll for 2025 Dependent Care FSA!, The 2025 dependent care fsa contribution limit returned to its previous limit of $5,000 after an increase by the american rescue plan act for 2025. Enter your expected dependent care expenses for the year ahead.

Fsa Dependent Care Limits 2025 Beryl Chantal, You can contribute a minimum of $120 ($10 per month) up to $5,000 each calendar year. A dependent care fsa lets a household set aside up to $5,000 to pay child care expenses for kids under age 13.

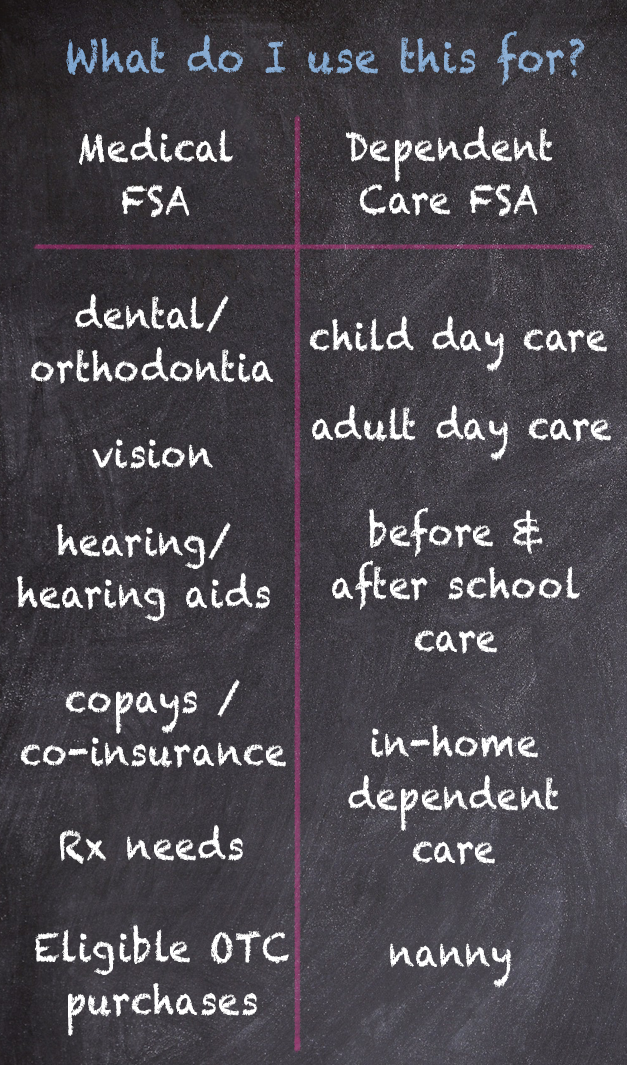

What is a Dependent Care Account? 2025 Inhome Care Expenses, The dependent care fsa (dcfsa) maximum annual contribution limit did not change for 2025. Find out if this type of fsa is right for you.

Dependent Care Fsa Limit 2025 Covid Ericka Deeanne, You are classified as a highly compensated employee as. Dependent care fsa income limit 2025 2025.

You can contribute a minimum of $120 ($10 per month) up to $5,000 each calendar year.

Budget 2025 may raise exemption limits, ease tax burdens.